All Categories

Featured

Table of Contents

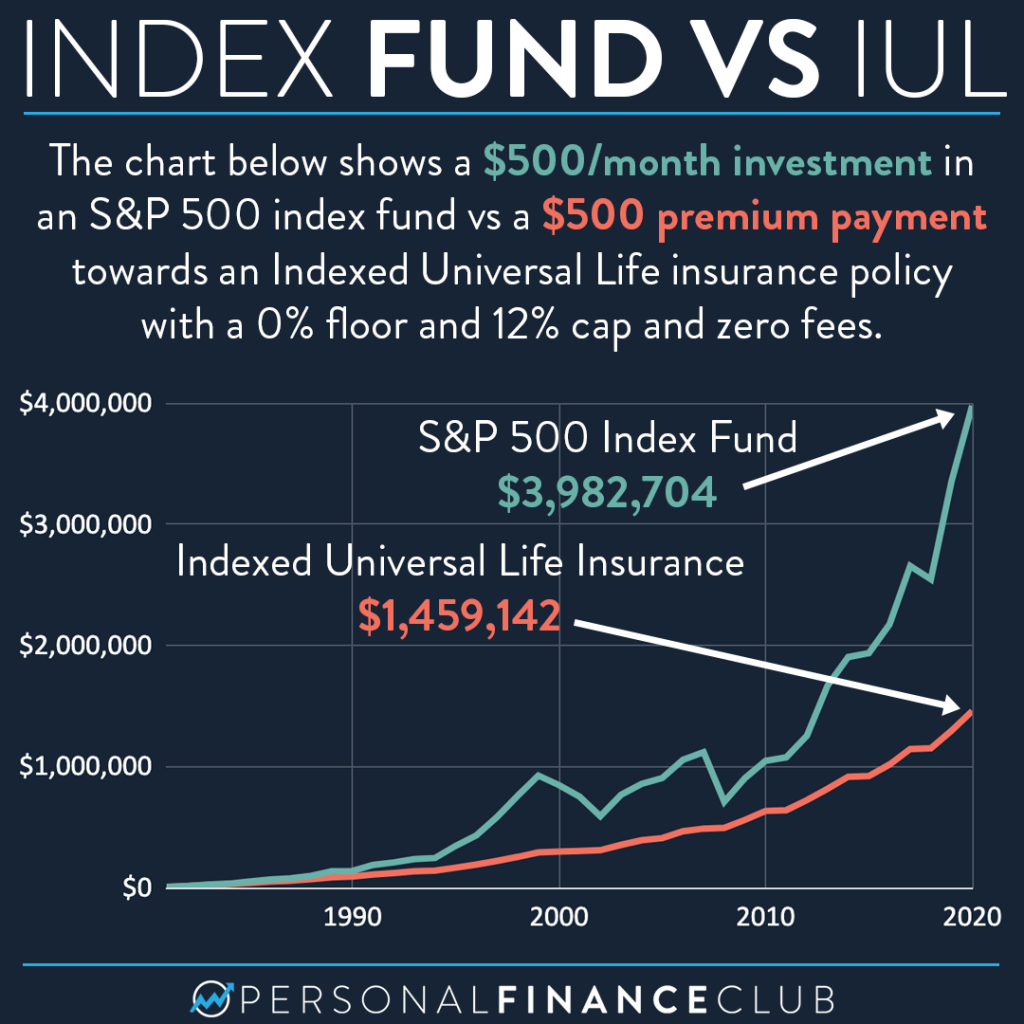

Indexed universal life policies provide a minimum guaranteed interest rate, additionally referred to as an interest attributing flooring, which minimizes market losses. Say your cash value sheds 8%. Many firms supply a flooring of 0%, indicating you won't lose 8% of your financial investment in this instance. Be aware that your money worth can decrease despite having a floor due to premiums and various other costs.

It's likewise best for those happy to presume added danger for higher returns. A IUL is a permanent life insurance plan that obtains from the properties of a global life insurance coverage plan. Like universal life, it permits adaptability in your survivor benefit and costs payments. Unlike global life, your money value grows based upon the efficiency of market indexes such as the S&P 500 or Nasdaq.

What makes IUL different from various other plans is that a section of the superior payment enters into annual renewable-term life insurance policy (Indexed Universal Life protection plan). Term life insurance, likewise referred to as pure life insurance coverage, guarantees death advantage settlement. The rest of the value enters into the overall money value of the policy. Keep in mind that charges need to be deducted from the worth, which would certainly lower the cash worth of the IUL protection.

An IUL plan may be the best option for a customer if they are trying to find a lifelong insurance policy product that develops wide range over the life insurance term. This is because it uses potential for development and also keeps one of the most worth in an unstable market. For those who have significant possessions or wealth in up front investments, IUL insurance coverage will certainly be a fantastic wealth management device, particularly if somebody wants a tax-free retired life.

Why do I need Indexed Universal Life Plans?

In comparison to other policies like variable universal life insurance, it is much less risky. When it comes to taking treatment of beneficiaries and managing wealth, here are some of the top factors that a person may choose to choose an IUL insurance policy: The money worth that can build up due to the rate of interest paid does not count towards earnings.

This means a client can use their insurance policy payment instead of dipping into their social safety money before they prepare to do so. Each plan should be tailored to the client's personal demands, especially if they are managing sizable possessions. The insurance policy holder and the agent can select the amount of danger they consider to be suitable for their demands.

IUL is an overall quickly flexible strategy. Due to the rates of interest of global life insurance policies, the price of return that a customer can potentially receive is greater than other insurance coverage. This is due to the fact that the proprietor and the agent can utilize call alternatives to boost feasible returns.

How much does Iul Growth Strategy cost?

Insurance holders might be brought in to an IUL plan due to the fact that they do not pay capital gains on the extra cash value of the insurance plan. This can be contrasted to various other plans that require taxes be paid on any kind of money that is secured. This suggests there's a money asset that can be gotten any time, and the life insurance policyholder would not have to stress over paying taxes on the withdrawal.

While there are various advantages for an insurance policy holder to select this sort of life insurance policy, it's except every person. It is essential to let the consumer recognize both sides of the coin. Below are some of one of the most vital points to motivate a customer to think about before choosing this option: There are caps on the returns an insurance policy holder can obtain.

The very best alternative depends on the customer's danger tolerance - Indexed Universal Life for retirement income. While the charges connected with an IUL insurance coverage deserve it for some customers, it is very important to be upfront with them regarding the prices. There are premium cost charges and various other administrative charges that can start to add up

No ensured passion rateSome other insurance policy plans use a passion rate that is ensured. This is not the instance for IUL insurance.

Who offers Long-term Iul Benefits?

It's attributing rate is based on the performance of a stock index with a cap rate (i.e. 10%), a floor (i.e.

8 Permanent life insurance consists insurance coverage is composed types: kinds life entire universal life. Cash money worth grows in a participating whole life plan with rewards, which are stated yearly by the business's board of directors and are not guaranteed. Cash worth expands in an universal life plan via credited interest and lowered insurance policy expenses.

Iul Protection Plan

Despite exactly how well you intend for the future, there are events in life, both anticipated and unanticipated, that can influence the financial well-being of you and your liked ones. That's a factor forever insurance policy. Survivor benefit is usually income-tax-free to beneficiaries. The death advantage that's generally income-tax-free to your beneficiaries can help ensure your family members will have the ability to maintain their standard of life, assist them keep their home, or supplement lost earnings.

Things like prospective tax obligation increases, rising cost of living, monetary emergencies, and intending for occasions like college, retired life, and even wedding events. Some kinds of life insurance can aid with these and various other issues as well, such as indexed universal life insurance policy, or merely IUL. With IUL, your policy can be a monetary resource, since it has the possible to construct value in time.

You can choose to receive indexed interest. Although an index might impact your passion credited, you can not spend or directly take part in an index. Below, your plan tracks, however is not in fact invested in, an exterior market index like the S&P 500 Index. This theoretical example is offered illustratory objectives just.

Charges and expenses may lower policy worths. You can likewise select to obtain fixed passion, one set predictable passion price month after month, no issue the market.

Why is Indexed Universal Life Retirement Planning important?

That leaves extra in your plan to possibly keep expanding over time. Down the roadway, you can access any kind of readily available money value with policy car loans or withdrawals.

Latest Posts

Cost Of Insurance Increase Universal Life

Best Equity Indexed Universal Life Insurance

Accumulation At Interest Option